Product description

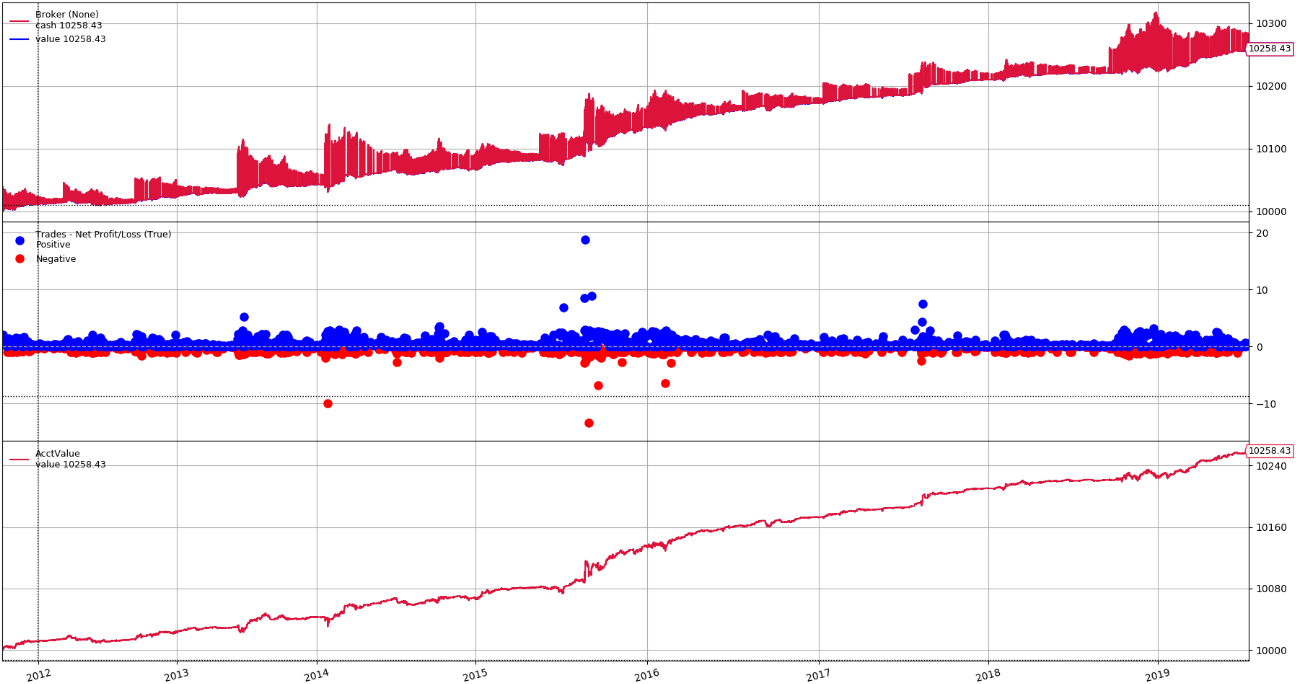

UVXY is a trading system using the principles of contangion decomposition for futures contracts and long-term decline in volatility. The system is based on folding a synthetic short position using option contracts on the underlying UVXY ETF traded on the NYSE Arca. The alpha factor is made up of commonly available indicators derived from UVXY five-minute price candles.

Number of users

The automated system is currently used by the development team.

Further development

Currently Paper trading – in the early stages of development we chose it due to the difficulty of performing a backtest on option data. We will have to solve the absence of data by interpolating and extrapolating the surface volatility using a suitable model, which will simply calculate the missing data.

Česky

Česky