Presentation of the the results in real operation, including the market fees

Below you can find more information about our Automated Trading Systems

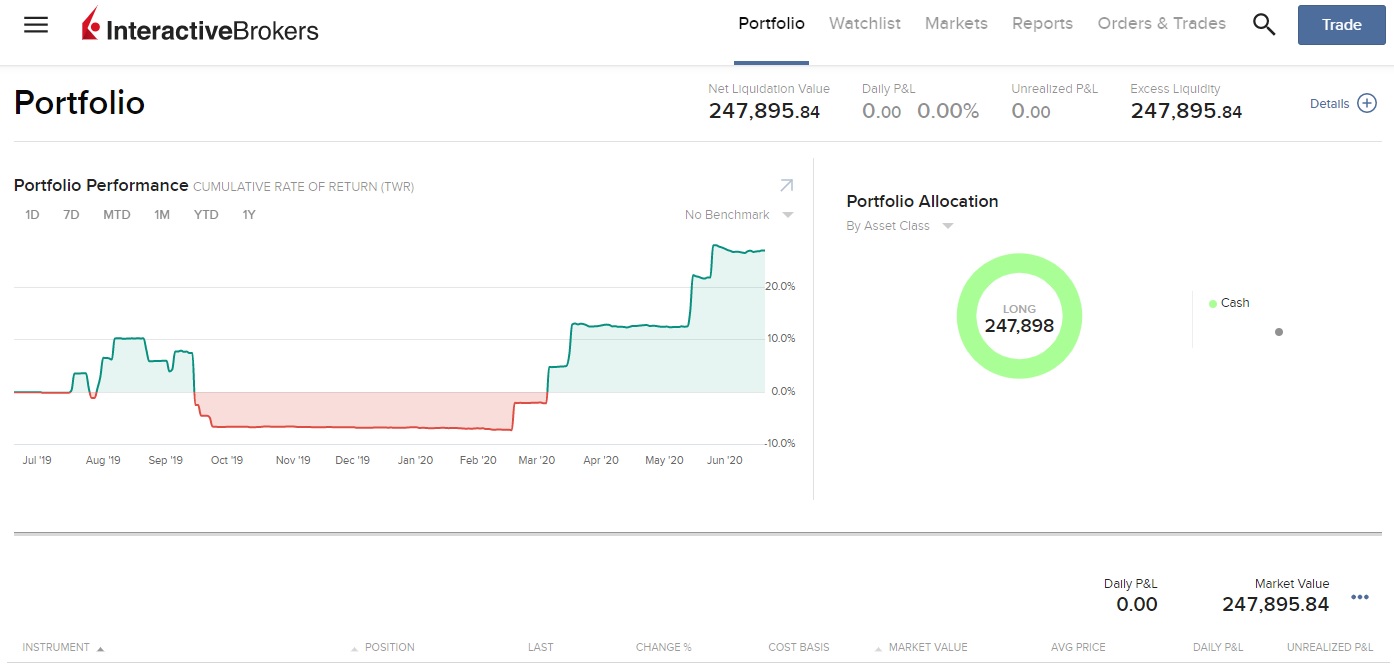

The expected profit of our ATS is 20 % p.a. We trade through the Interactive brokers platform.

Momentum Formula II

Momentum Formula is a business system based on the quantitative analysis of the market structure and is fully automated (= automatic calculation and insertion of the limit order, stop-loss order, automatic shift of the stop-loss order when reaching the break-even point). Orders are executed in the futures markets of COMEX and NYMEX. We speculate on the rise / fall in the price of oil / gold. If successful, our profit is around $ 500, if we are unsuccessful, our loss is around $ 250. The backtested probability of success is about 40%.

Illustrative image, not updated according to the performance table above.

In September 2019, we realized a larger loss due to an error of the MKT order type. ATS placed a Market order and, due to a weekend attack in the UAE, there was no counterparty to trade at the expected price, after the market was opened. The system was subsequently shut down and an updated version was deployed in March 2020, also with a new LMT Market order.

Stock Picker

AI-powered data tool for smart decision-making process in the stock market. Our research team have developed a model for market inefficiency exploitation (researchers call it no-arbitrage condition violation). Stock portfolio can be designed with the tool to ’beat the market’. The Stock-Picking Model for stock ranking is based on expected risk-adjusted returns. In the portfolio, 20 stocks are always held in the Long position (speculation on growth) for which, according to our model, the largest growth is expected and 20 stocks in the Short position (speculation on a decline) for which we expect the largest decline. Long positions are bought for about $ 750 (For example, if Apple Inc. (AAPL) costs $ 351, we buy 2 shares for $ 702), Short positions for about $ 500. The portfolio is rebalanced once a month. Portfolio is selected from the S&P 100 index, which includes shares of the 100 largest listed companies on the US stock exchange.

Illustrative image, not updated according to the performance table above.

Česky

Česky