|

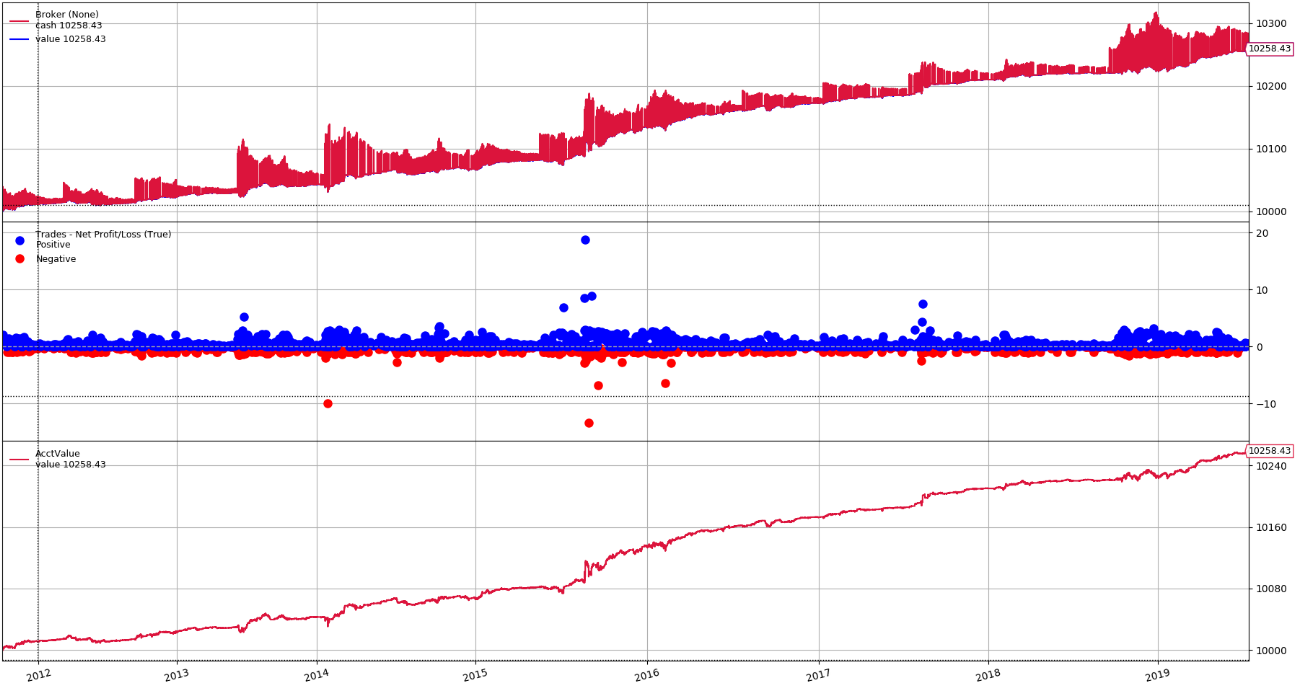

Provision of signals generated by our automated trading systems |

Our ATSs operate on the world’s Stock exchange markets (NYMEX, COMEX, NYSE Arca). We build automated trading systems on our own infrastructure. We mostly trade through Interactive Brokers.

|

Performance improvements of your trading strategies |

We offer the development and enhancement of trading strategies by using genetic optimisation, machine learning and time series modelling.

Every trading strategy can be reinforced, alternatively enhanced by one of the following points:

- automation = workflow efficiency improvement (market scanning/seeking opportunities, backtesting, data preprocessing, execution),

- robustness (using statistics including relations between “blind spots” on equity curve and market, albeit undetectable, phenomena),

- optimisation (connecting more uncorrelated assets) in order to reduce risks/drawdowns and drawdown period.

Learn how to build advanced trading systems here

Česky

Česky