We will simplify your work

Do you need excellent quality analytical software? Are you hesitant while deciding on diversification, risk management and finding suitable investments?

Try out and see

Gear up your company! Use the same applications which proved successful at strong European and world funds. Join the successful ones too.

Reach the best results by utilising visualisation, advanced analytics and automation of a wide range of steps. The ability to answer even complex queries more precisely will make you strong competition in the asset management market.

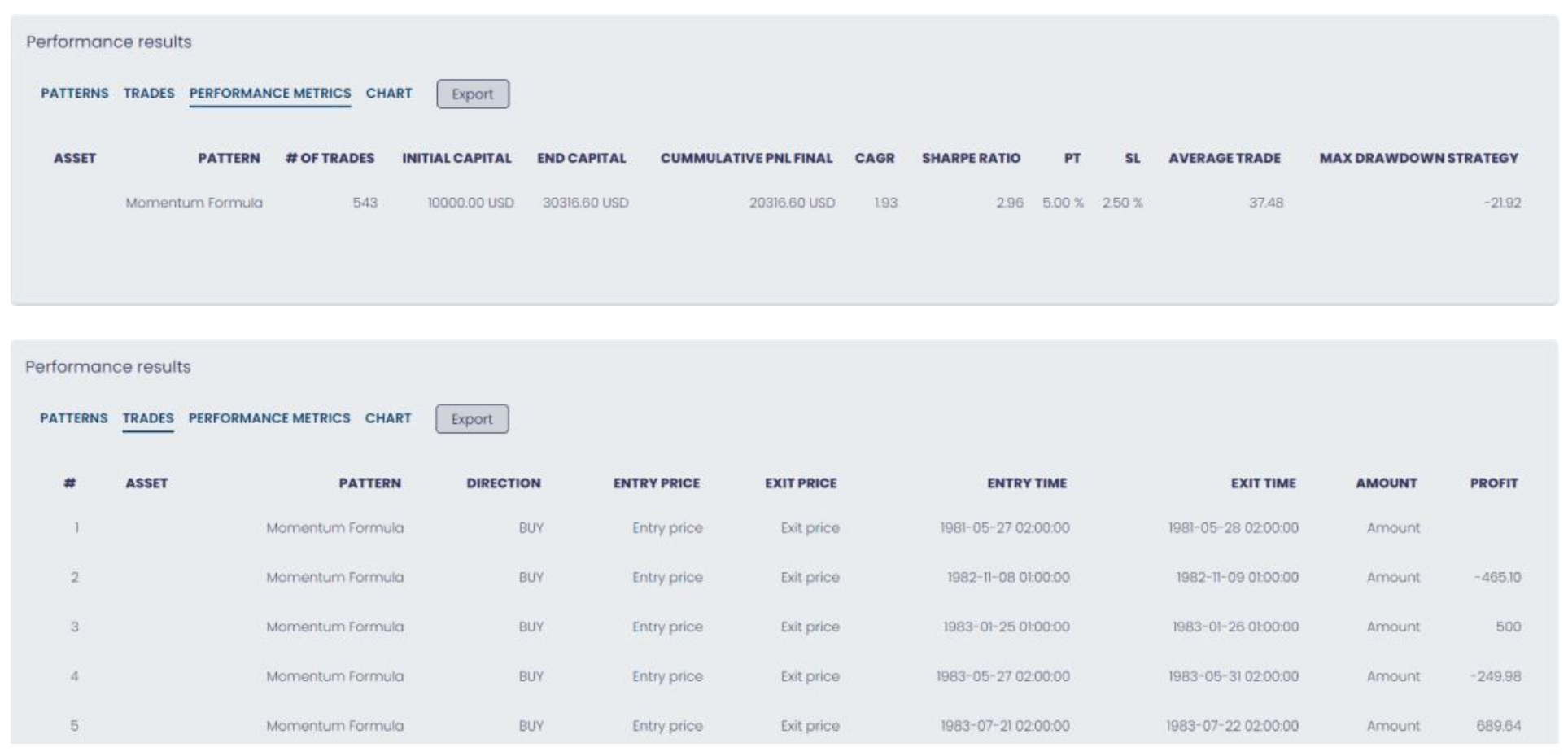

Results of systems using our tools

| Automated trading system | Momentum Formula | Stock Picker |

| Update | 31 December 2020 | 31 December 2020 |

| Start trading | 17. July 2019 | 03 June 2020 |

| Performance p.a. (%) | 12.65 % | 26.84 % |

| Performance p.a. (%), without fees and forex* | 15.62 % | 36.52 % |

| *The portfolio performance freed from the broker’s fee may be a better telling indicator. For instance, the Stock Picker system trade fee is 1.01 USD, whether investing 700 USD or 7,000 USD. When managing the portfolio in CZK, there is also a foreign exchange risk. | ||

We have joined forces and put together our development of financial technologies. We are a team of financial engineers, data analysts and developers from CCF RESEARCH, a. s. and Mendel University. Furthermore, professionals from Prague University of Economics and Business collaborate on some projects.

Ing. Michal Dufek

Financial research software development leader. He graduated from Prague University of Economics and Business, Faculty of Informatics and Statistics. As part of his R&D activities, he focuses on data analysis, Bayesian inference and time series modelling.

T: +420 774 372 831

@: michal.dufek@ccfr.cz

Our latest applications include the StockPicking Model for stock selection; PatternLab whose purpose is to find price patterns; the Scoring Model for the elimination of loss periods at actively managed investment strategies. However, we can also value structured products and optimise portfolios. Take a look at the individual modules we offer.

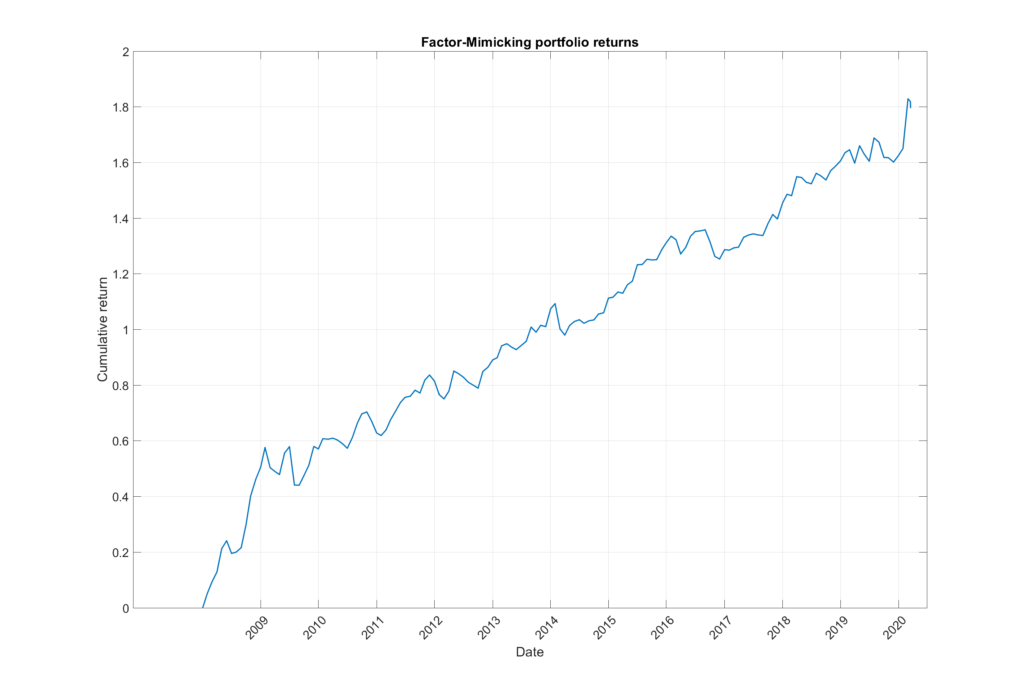

A. Pick your stock via the StockPicking Model

Have clear data when deciding on what to currently invest in. Having precise input data and a solid base is essential when investing. The StockPicking Model will make your stock selection easier. Let the model recommend the currently most convenient stocks for building your long & short portfolio. The application can be used as a guidance tool when deciding what is worth investing in or it can help you build an entire portfolio. You can set an investment (rebalancing) horizon of your portfolio. It can be a day, week, month, three months or half a year. After this time has elapsed, the trading platform will provide you with new data, which will help you adjust your stock portfolio according to your current needs.

How does it all work? The StockPicking Model is based on a macro indicator analysis – in the case of companies, on the analysis of specific predictors – and their consequent Bayesian selection. The average annual yield reaches 17.69 %, while the maximal decrease in value reaches 13.72 %. In the chart below, you can see a historical stock portfolio performance composed from the application data.

B. Have an overview with PatternLab

Save your time and simplify looking for price patterns. The PatternLab application will prove useful, particularly when building technical analyses. Price patterns can be used in all financial, stock and commodity markets, and even cryptoassets. Up to date, our database registers over 70 of them. PatternLab can create well-designed statistics about the number of certain pattern occurrences. At the same time, you also get information about the previous days’ stock development.

Track all tools – including price patterns – comfortably in a bundled solution at one place.

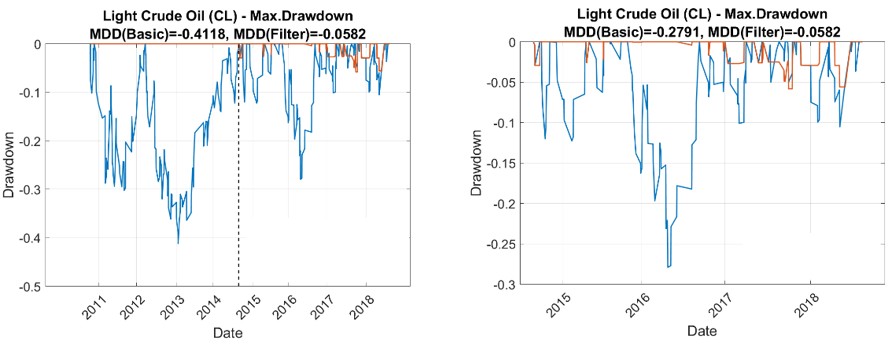

C. Eliminate losses with the Scoring Model

Do not throw your money down the drain. With the Scoring Model, you can eliminate decreases in your trading strategy and protect your investments. You know it, one moment, your trading strategies are very successful and doing well, but suddenly, there is a time when the value of the managed asset starts to decrease. Avoid similar negative jumps by using the Scoring Model application. It can recognise transactions performed at the time which is not very favourable to your investment strategy and subsequently cancels it. Doing this decreases the likelihood of losing assets and at the same time improves performance ratios.

The following chart can give you an idea of how the application works. It shows an asset value decrease at a momentum strategy trading oil financial futures. The deepest trading strategy falls decreased from 27.91 % to 4.95 %. This leads to improvement of the strategy performance ratios.

D. Value structured products

Be up to date about where your money goes. The times when investors were offered a mix of bonds and stocks are gone – now structured products are popular. However, there is a catch: the real trade price of structured products is often different from the one the investor pays. How to outsmart it? By using our application for structured products valuation. Let it compare the prices of individual investment alternatives and be clear about how profitable trade awaits. Do not pay unnecessarily high margins.

E. Optimise your portfolio

Maximise your yield and eliminate risks. Portfolio optimisation can dynamically adjust the value of purchased assets in a way that your overall risk-performance profile meets your expectations. By following this approach, all risk and yield combinations range in the area of “efficient frontier of portfolios”, which, in short, means that you either maximise the profit at a tolerated level of risk or that you minimise risks at a required level of risk. Moreover, we have equipped this application with models which can estimate future correlations among investment tools included in the portfolio. Knowing this information, you have the opportunity to look into probable events in the near future. Eventually, you can rebalance your portfolio the moment the market tension increases. With the help of our application, the risks related to a sudden drop in asset prices at times of increased volatility will be reduced.

Česky

Česky